The May 12 Sino-US Geneva Trade Talks agreement reduced tariffs significantly. US tariffs on Chinese goods fell from 145% to 30%. China’s tariffs on US goods dropped from 125% to 10%. This sparked hope for China’s export market. Steel prices and trading volumes saw a noticeable surge following the news, highlighting renewed optimism across the global steel trade market. However, the peak season is winding down. Weak demand in real estate is limiting new housing projects. This could stall growth. Steel prices may rise unevenly in the short term. Yet, momentum might fade due to daily price swings.

Historical Context of Steel Tariffs

Introduction and Use of Steel Tariffs

For decades, nations have leaned on steel import taxes to cushion homegrown producers from overseas competition. Back in 2018, America slapped major duties on foreign steel shipments. This move used Section 232 from the 1962 Trade Growth Law. They claimed defense interests were at stake.

These charges tacked an extra 25% cost onto steel brought from abroad. The strategy? Safeguard U.S. steel mills from budget-priced imports. Chinese suppliers were particularly targeted. These steps tried achieving two things. First, they wanted to reinforce America’s metal manufacturing base. Second, they aimed to cut down import needs. For steel buyers, this translated into higher costs for grades like tool steel, spring steel, and structural plate, directly impacting manufacturing margins.

Economic Effects After Tariffs

The tariffs had immediate impacts. US steel prices jumped over 30% in months. Local producers benefited from higher demand. However, industries like automotive and construction faced pricier steel inputs. This raised costs across sectors. It also sparked worries about weaker global competitiveness. Retaliatory tariffs from other countries further tangled trade. US exports took a hit.

Current State of Steel Prices

Global Demand and Supply Trends

Global steel demand stays strong, driven by infrastructure and industrial growth in developing nations. Yet, supply chain issues from geopolitical tensions and the COVID-19 pandemic have limited production. This mismatch fuels price swings. China, a major steel producer, has cut output to meet environmental targets. This tightens global supply further.

Raw Material Costs and Price Changes

Raw materials like iron ore and coking coal heavily influence steel prices. Recent spikes in these costs have raised production expenses. Mining disruptions and transport issues cause periodic price surges. AR 500 is used in mining industry, which is influenced accordingly. Then, these costs often pass to buyers, pushing steel prices higher. For example, the average price of iron ore increased by 18% in Q1 2025 compared to the same period in 2024, putting additional pressure on production costs for wear-resistant steel like AR500 and high-strength alloy plates.

Regional Differences in Steel Prices

Steel prices differ by region due to varying production, trade policies, and local demand. In North America, tariffs and limited local output keep prices high. Europe faces similar issues, plus rising energy costs that hurt manufacturing. Asian markets, however, offer lower prices due to high production and government support.

Ongoing Impact of Tariffs on Steel

Changes in Trade Strategies

Tariffs have forced countries to rethink trade approaches. Steel-exporting nations have sought new markets or tweaked products to stay competitive. Importing countries have diversified suppliers or boosted local production. This has reshaped global steel trade patterns.

Effects on Producers and Buyers

Local producers have gained from tariffs, enjoying larger market shares and better profits. Buyers of industrial steel, such as automotive manufacturers, mining operations, and construction firms, face tighter profit margins due to elevated prices of cold-rolled sheets, alloy structural steel, and abrasion-resistant plates. Some firms raise prices to cope. Others struggle to compete globally and locally.

External Factors Shaping Steel Price Futures

Geopolitical Tensions and Price Swings

Geopolitical conflicts consistently drive steel price volatility. Trade disputes and wars disrupt supply chains, raising costs. For instance, US-China trade clashes lead to tariffs and sanctions, affecting steel trade. Regional conflicts also limit raw material access, like iron ore and coking coal. The Russia-Ukraine war has disrupted Ukraine’s iron ore exports. Sanctions on Russia curb its steel exports. These events create an unstable pricing landscape.

Innovations for Cost and Environmental Gains

New technologies aim to cut costs and environmental impact in steel production. Electric arc furnaces (EAFs) use recycled scrap, reducing emissions and energy use. Green hydrogen is emerging as a cleaner alternative to coking coal. These advances support global net-zero goals by 2050. They also help firms manage costs tied to environmental regulations.

Future Trends in the Steel Market

Industrial Growth and Infrastructure Needs

Industrial expansion and infrastructure projects drive steel demand. Emerging economies in Asia and Africa invest heavily in transport, housing, and renewable energy. These require vast amounts of steel. In developed nations, stimulus plans, like the US Infrastructure Investment and Jobs Act, boost demand by upgrading roads and bridges. Still, supply chain hiccups or raw material shortages could push prices up.

Policy Shifts and Trade Deals

Government policies shape steel prices. Tariffs and subsidies protect local industries or address trade gaps. The US’s Section 232 tariffs, for example, limited imports and spurred local production. Trade agreements that ease barriers improve access to materials and foster competition. Protectionist moves, however, can raise consumer prices by limiting competition. Tracking these policies is key to understanding price trends.

Possible Steel Market Outcomes

The steel market’s future hinges on multiple factors:

- Optimistic Case: Easing geopolitical tensions and smoother supply chains could stabilize or lower prices with better production.

- Pessimistic Case: Ongoing conflicts or stricter green rules might tighten supply and raise costs.

- Moderate Case: Industrial growth balanced by tech advances could lead to gradual price increases.

Stakeholders must stay alert to these scenarios for strategic planning.

Summary

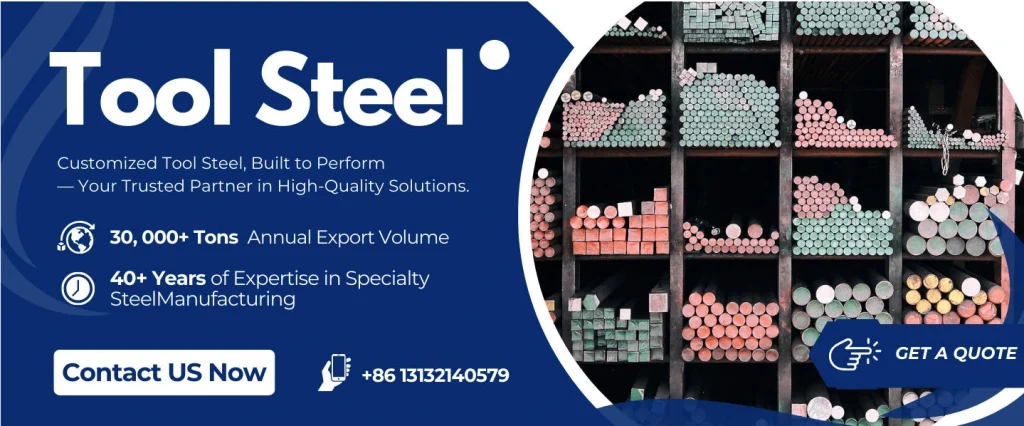

Steel prices are shaped by geopolitics, technological advances, industrial growth, policies, and trade deals. Tariffs and global conflicts pose challenges. Yet, sustainable practices offer cost-saving opportunities. Promispecial® stands out in today’s volatile market as a trusted supplier of high-grade steel, including automotive sheet metal, wear-resistant steel, and specialty tool steel. Through precision sourcing, advanced metallurgy, and client-first delivery solutions, we help our global partners stay competitive and resilient. For inquiries about our high-quality steel products, please contact us today!

FAQ

Q: Why have steel prices gone up by 30%?

A: Steel prices surged due to tariffs, like the US’s 25% duty on imports started in 2018. These raised costs for foreign steel, boosting demand for pricier local steel. Supply chain issues and high raw material costs, like iron ore, also pushed prices higher.

Q: What tariffs are affecting steel prices?

A: The US’s Section 232 tariffs from 2018 added a 25% duty on imported steel, citing national security. Other countries responded with retaliatory tariffs, complicating trade. Recent Sino-US trade talks cut tariffs (US: 145% to 30%; China: 125% to 10%), but effects linger.